Posted on February 16, 2024 by Duval Home Buyers in Sell Your House Jacksonville, Sellers

The Start of the Home Selling Season and a Look at 2024 to Come

As fans in Kansas City celebrated their Super Bowl LVIII victory over San Francisco last Sunday, Realtors® all around the country were gearing up for the start of the 2024 spring home selling season. Each year the Super Bowl kicks off what is considered the season’s unofficial start, and buyers and sellers alike should begin considering their plans for the upcoming year.

But what does the 2024 selling season have in store for sellers in the Jacksonville market? Here’s our take on the current data from 2023 and what it could mean for the coming year.

Housing Affordability

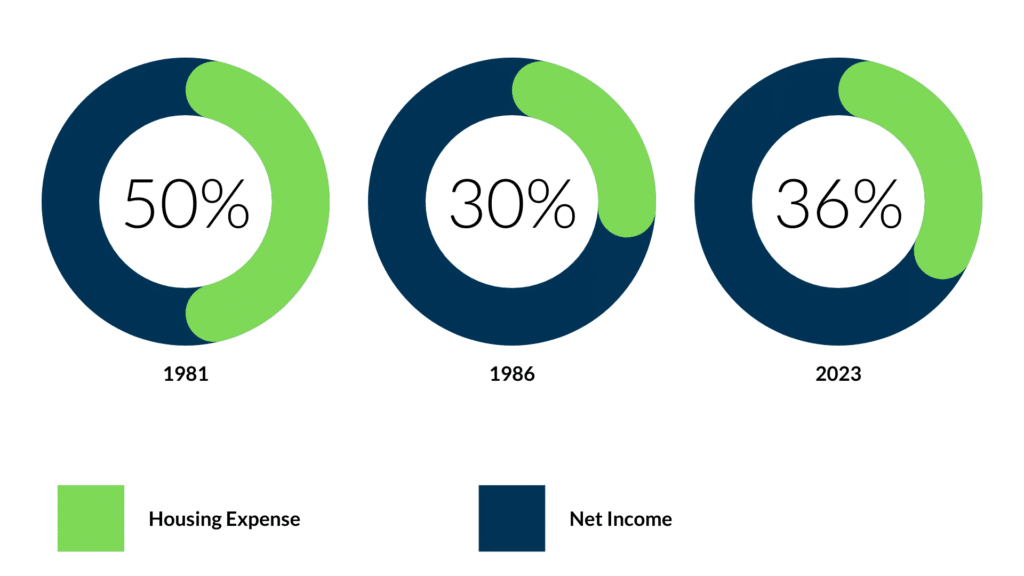

According to reports published by Black Knight, a mortgage data company headquartered here in Jacksonville, 2023 was the least affordable real estate market since 1985, almost 40 years prior.

For reference, In 1981 the average monthly payment of a newly originated mortgage took up about 55% of the median household income, indicating that most buyers would become “severely cost-burdened” by purchasing a home. By 1986 that figure had decreased to 30%, which is only considered “cost-burdened”.

Housing burdens over time for newly originated mortgages.

With rates for a 30 year fixed mortgage in the high 6’s and low 7s for a majority of the year, and home values continuing to climb, the average mortgage payment for a new loan in 2023 took up 36% of the monthly income, higher than that of 1986, and putting a majority of would-be homebuyers into a bracket that would make them “cost-burdened”.

As a result home sales have slowed, and many homes are spending far longer on the market before selling, even if they sell for a premium price.

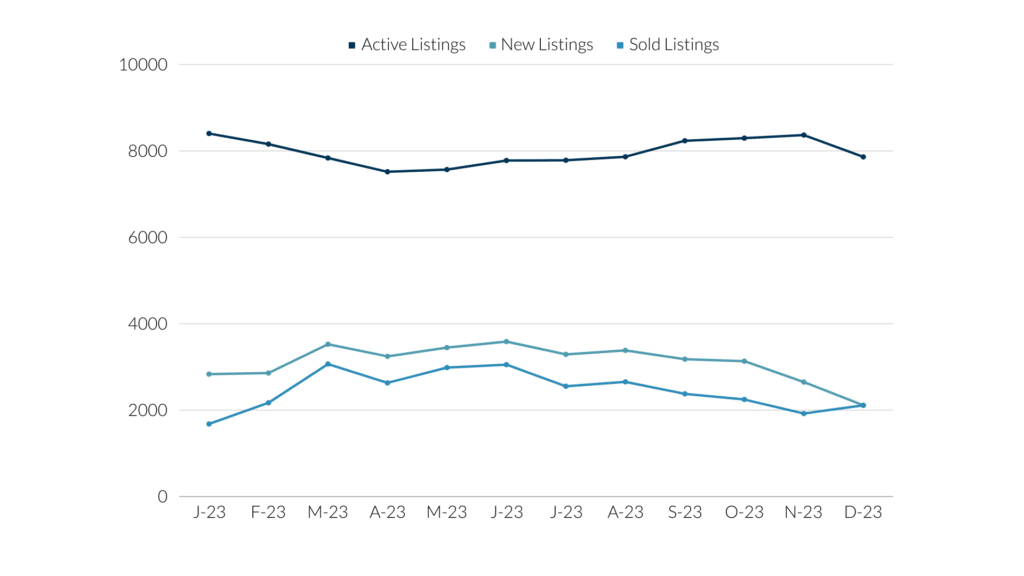

2023 Jacksonville Sales Data

2023 was a difficult year for real estate at the national level. Nearly 1 million fewer homes sold in 2023 when compared to 2022. Considering that the average year sees about 5.5 million sales nationally, 1 million represents an incredibly steep decline of just over 18% .

According to reports from the Northeast Florida Association of Realtors, there were 29446 residential sales of on-market Jacksonville homes in 2023. An 11% decrease from the 33072 sales in 2022. Homes in the $120,000-250,000 price range saw the biggest declines, though this can be largely attributed to rising home prices reducing the overall volume of lower-cost home options.

2023 NEFAR Listings Data

A First Look at 2024

According to the same reports provided by the Northeast Florida Association of Realtors, January 2024 is also off to a slow start, showing only 1510 residential sales. A 10.1% decrease year over year from the 1680 residential sales in January 2023. Additionally, the average number of days on the market has increased to 68, a 3.03% increase year over year.

The average sales price offers a silver lining however, showing an 11.7% year over year increase from $406,789 in Jan 2023 to the current average of $454,365 in Jan 2024.

Additionally, the ratio of selling price vs listing price is also showing promise at 93.8%, a .8% increase from 2023. This statistic is highly seasonal, and tends to rise as the spring season gets underway.

Other Factors to Consider

For buyers and sellers alike, interest rates will dictate much of how the real estate market in Jacksonville operates this year. Rates have been at historically high levels since late 2022 when the average 30-year fixed rate suddenly spiked from the unprecedented lows brought on by the COVID-19 pandemic to values last seen in 2008 during the real estate crash.

While rates have cooled since their summer 2023 highs, the 30 year fixed-rate mortgage still averages 6.977% APR according to Nerdwallet. Expectations were high that rates would continue this cooling pattern throughout 2024, but recent comments by Fed Chair Jerome Powell and Treasury Secretary Janet Yellen have cast some doubt on whether or not inflation numbers have cooled enough to justify the rate cuts needed to bring mortgage rates down.

Original expectations from the talking heads put rates in the high 5s by years end, but revised expectations have simmered, with an expectation that rates will cool into the low 6s at the current trend.

Even a slight reduction in mortgage rates can have a significant impact on affordability, but unless rates begin to slide, the reality that sellers may continue to face a reduced buyer pool is all too likely.

Sliding rental prices are another factor that could influence Jacksonville home sales in the coming year. Average residential rents have been fairly stagnant in Jacksonville over the past 12 months, rising by only 1.09%. Nationally, the rental market has been softening, with many metros seeing a decrease in rents rather than an increase.

Much of the 2021 buying frenzy, which helped to jumpstart the rise in home values was attributed to landlords and investment buyers looking for rental income. As those buyers see diminished returns, many may exit the market, thinning an already slim buyer pool.

Will 2024 Be A Good Time to Sell

The question of whether 2024 will be a good time to sell is unfortunately somewhat loaded, as it is entirely dependent upon your selling needs. For some, life events such as relocating for a new job, divorce, death, or the birth of a child can make selling the best option, or even the only option regardless of the market. For others who purchased at lower prices or have mortgages with low interest rates, it may be better to sit back and wait for rates to drop enough for home sales to pick up.

Ultimately the question also needs to be asked: where are you going to go? High rates and prices mean that even those looking to make a move may have difficulty upsizing or even transitioning to a like kind home without an increase in expense.

Ultimately, while we believe that home prices should continue to rise at a slow pace, and expect a slow albeit healthy market in 2024, whether or not 2024 will be a good time for you to sell is entirely based on your personal needs. The first step when deciding whether or not to sell your home should be to take a hard look at your wants and your needs, so that you can best structure the deal that works for you.

Options When Selling in 2024

Depending on your timeframe and your needs, you have multiple options for selling a home in 2024.

The first is the most traditional way, by using a real estate agent to list and sell your home on the MLS. There are many seasoned agents in Jacksonville who can help you get top dollar for your house. However it is important to remember that the average number on market for a home in Jacksonville in 68. For those looking for a simpler, more streamlined way to sell their house, it may not be the best option.

Another way is to sell FBSO, or by owner. When you sell by owner, you get full control of the sale, but you are also responsible for setting the price and marketing your home to potential buyers. More than 80% of FSBO sales fail or end up listing with a real estate agent.

The fastest way to sell your house in Jacksonville is to sell to a cash buyer. A seasoned, experienced investor can quickly close on your home, ensuring certainty and simplicity in exchange for a little bit of equity. You won’t make as much cash for your house, but it will be much easier to sell, especially in a different market.

Be sure to research your options fully and to speak with licensed real estate professionals about your needs. Your ultimate goal when selling your home, should be to sell it well in a way that makes you feel happy with your sale.

If you want a no obligation consultation or cash offer for your home in Jacksonville, Duval Home Buyers is here to help. For over 15 years our licensed agents have been buying and selling homes in Jacksonville.