Posted on September 21, 2022 by Duval Home Buyers in Buyer, Home Sellers, Sell My Home Jacksonville, Sell Your House Jacksonville

Rising mortgage rates – what they mean for sellers

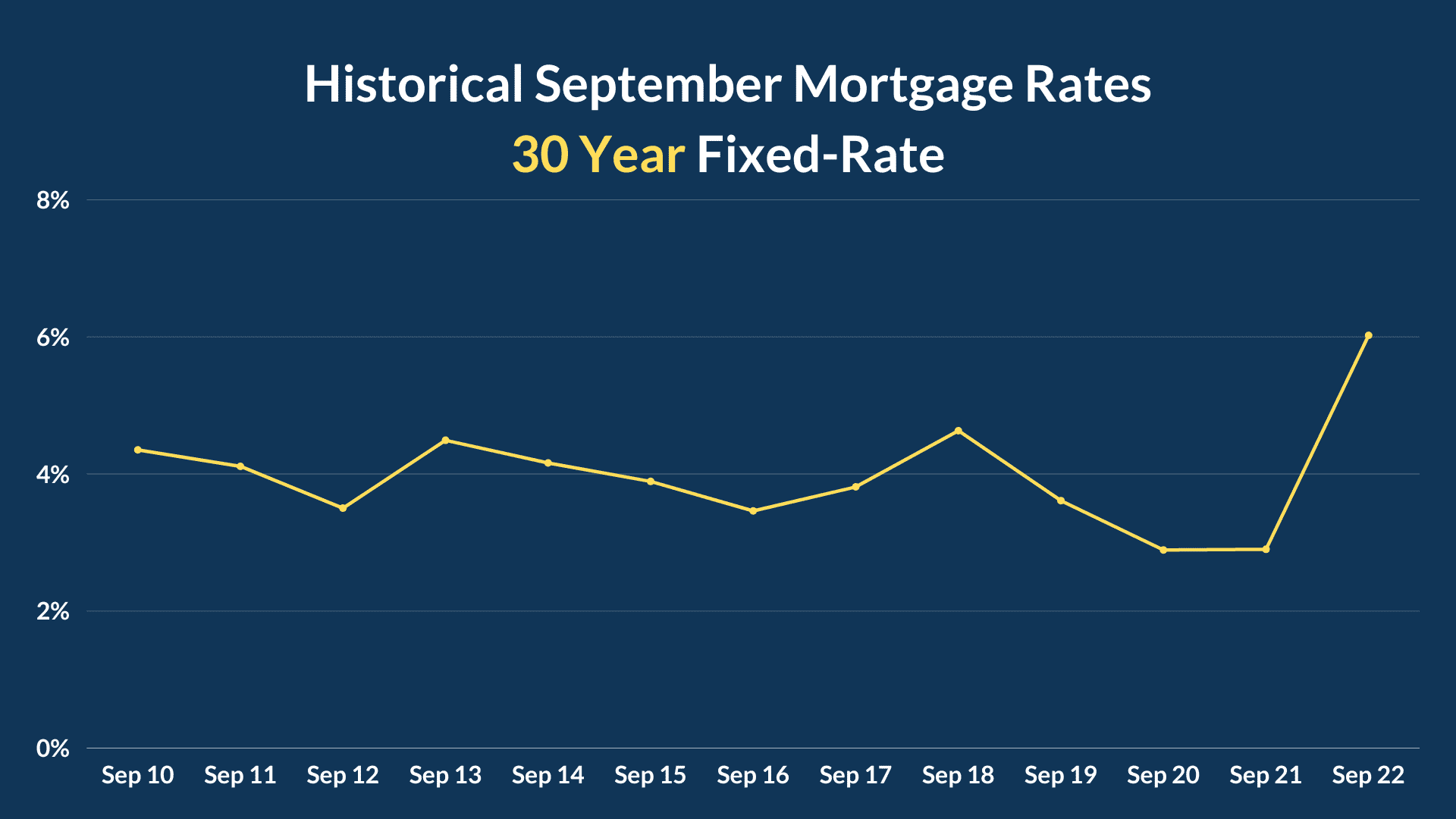

Mortgage rates have been rising since the start of the year, climbing above 6% in September. Thanks to the Federal Reserves commitment to curbing inflation they appear unlikely to fall any time soon.

Inflation remains resiliently high according to the August Consumer Price Index, affirming the likelihood of another large rate hike before the month’s end. The Fed has already increased rates by 2.25% Since May 2022, and the consensus is that another 75 to 100 basis point hike is likely.

But what does that mean for the average homeowner? Is this a repeat of 2008? Is it time to sound the alarms? Not quite, but it may affect your ability to sell.

How does the Fed affect mortgage rates?

While mortgage rates aren’t a direct reflection of the Fed’s key interest rate, hikes and cuts do have an influence. This is because most rates, including the 30 year fixed-rate mortgage, the most popular type of home loan, tracks 10-year Treasury Bonds. Inflation and predictions around the Fed’s response drive the outlook for these bonds. As such, they are indirectly, albeit heavily affected by fluctuations in the key rate.

“High inflation requires the Fed to be even more aggressive than previously assumed, and, therefore, the broad bond market – including the mortgage market- has reacted” said Lawrence Yun, chief economist for NAR.

Why are rates suddenly skyrocketing?

In the early months of the Covid-19 pandemic, as unemployment reached a staggering 16%, the Fed held an emergency meeting to discuss potential rate cuts to help struggling Americans. Subsequently rates fell as low as .05%, levels unseen since the great recession of 2008. Borrowing became effectively free.

Mortgage rates were quick to react, dropping to a historic low of 2.68% for the 30 year fixed-rate in December 2022.

Compounded by supply chain issues, this sudden decrease in the cost of borrowing created a frenzy of demand, sending home prices, as well as commodity prices soaring.

As the dust from the pandemic settled, prices have been slow to react, and the US economy has begun to feel the strain of those increased costs. In August inflation was over 8.3%. Meaning that commodities in August 2022 cost an average of 8.3% more than those in August 2021. In an effort to reduce demand, in turn reducing the strain on supply, the Fed has worked to quickly curb wanton spending by making borrowing more expensive.

With the jump from rates of .05% to 2.25%, mortgage rates have adjusted accordingly.

How do mortgage rates affect the value of my home?

Most home buyers use loan products to pay for their homes. It’s unrealistic that someone has the hundreds of thousands of liquid cash required to buy a home available to them. In fact the median US home sale price reached $428,700 as of the end of the first quarter of 2022.

Mortgage loans, usually in the form of the 15 and 30 year fixed-rate loans, offer long term financing solutions which make those staggering costs affordable. However, these mortgage products come with a catch. Interest.

In a mortgage the cost of the home is amortized over the term of the loan, with interest calculated monthly based on the “principal” or mortgage balance due. These loans are set up so that the monthly payment due remains constant throughout the loan term. Meaning that the percentage of your payment going to interest vs. that going towards the principal changes throughout the life of the loan, while your monthly payment amount does not.

Here’s an example:

Let’s assume you want to buy a $250,000 home and you plan to put 20% or $50,000 down. This leaves you with a mortgage balance of $200,000.

At the current rate of 6.02%, without taxes, fees, or insurance, your monthly payment will be $1201.67 for the full 360 month term of the loan. That’s 360 payments of $1201.67 for a total of $432,601. Subtracting that $200,000 originally owed, you spend $232,601 on interest. More than you borrowed on the house itself.

If you take that same $250,000 home and down payment, and you lower the rate by 1% to 5.02% your payment decreases to $1067.09. An 11.2% decrease in your monthly payment. Then, multiplying that by the full 360 month term of a 30 year loan, your total balance becomes $384,152. That’s a 10.4% decrease in the total cost of the home for a 1% change in interest rates.

In fact, a good rule of thumb is that for every 1% change in mortgage rate you will save or spend an additional $50,000 per $200,000 on the cost of a home over the lifetime of the loan.

So how does this affect value? Simply put, a higher interest rate makes your home significantly more expensive for a buyer, even if the price hasn’t changed. That $200,000 house cost $280,015 with a year loan in 2021 at 2.38%. It now costs over $432,601 in 2022.

With fewer buyers able to afford the increased price, demand falls and supply increases. As supply increases, prices are usually cut to make a listing competitive. Your house is worth only as much as someone will pay for it.

So what will happen to my home’s value?

Honestly, it’s impossible to tell what the long term effects of these rate hikes will be on home prices. But we are able to forecast that the rampant growth is unlikely to continue. Historical growth rates for home values average just over 5%, whereas the growth rate in 2021 was over 18%.

Many homes were over valued because low rates made monthly payments affordable, even at inflated sale prices. As these homes return to the market, it’s very possible, plausible even, that the prices will need to be reduced below the prior purchase price in order to entice buyers. Effectively selling at a loss.

Many large companies which purchase homes, such as Opendoor and Offerpad have slowed buying due to uncertainty in the market and reduced values. In fact Opendoor claims that they’ve sold over 42% of the homes purchased in August at a loss. And Zillow exited the home buying game all together in late 2021 after sustaining heavy losses on resales.

It is still a sellers market. But inventory levels are rising at an astounding rate. NEFAR reports that monthly inventory has risen over 166% YoY since August 2021. Sales by comparison have only risen 24% for the same period. Leaving a growing gap in available inventory.

While the best time to sell may have been yesterday, the second best time to sell is likely today. Just be prepared for below asking offers and some time on the market. The frenzy has met its end.